work opportunity tax credit questionnaire (wotc)

The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment. It contains questions related to.

Wotc Questions Do You Have An Online Application For Wotc Cost Management Services Work Opportunity Tax Credits Experts

PdfFiller allows users to Edit Sign Fill Share all type of documents online.

. Ad Help simplify the WOTC process identify eligible employees capture more tax credits. Completing Your WOTC Questionnaire. Work Opportunity Tax Credit WOTC The WOTC is a tax incentive for employers to hire certain hard-to-place job seekers.

ETA Form 9061 Individual Characteristics Form. Questions and answers about the Work Opportunity Tax Credit program. There are two sets of frequently asked questions for WOTC customers.

After the required certification is secured taxable employers claim the WOTC as a general business credit. Quickly help identify more WOTC eligible employees and increase available tax credits. Completing Your WOTC Questionnaire.

Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now. The program has been designed to promote. Page number one of Form 8850 contains the questionnaire of the Work Opportunity Tax Credit.

Full WOTC credit requires 400 hours of work. Is participating in the WOTC program offered by the government. The Work Opportunity Tax Credit is a voluntary program.

If so you will need to complete the questionnaire when you. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc. All voice telephone numbers on this website may be reached by.

The Work Opportunity Tax Credit WOTC is a federal program established in 1996 to promote the hiring of individuals from select target groups that face barriers to secure employment. An equal opportunity employerprogram. The Leading Online Publisher of National and State-specific Legal Documents.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Maximum tax credit is 5600 per new hire. Calculate 40 of wages earned up to 14000 wage cap.

To receive the minimum tax credit worth 25 of a workers wages a company need only employ a worker for 120 hours or about three weeks of full-time work. The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically. As the WOTC can.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers for hiring individuals from specific target groups who have consistently faced significant barriers to. ETA Form 9062 Conditional Certification. In the case of the above question the.

Quickly help identify more WOTC eligible employees and increase available tax credits. Edit Sign and Save TALX Tax Credit Questionnaire Form. WOTC joins other workforce programs that incentivize workplace diversity and facilitate access to good jobs for A See more.

Is a member of a targeted group before they can claim the tax credit. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Unlike many state incentives. Work Opportunity Tax Credit Questionnaire. Does your company claim the Work Opportunity Tax Credit WOTC a federal tax credit designed to encourage businesses to hire individuals from certain targeted groups.

The goal is to help these individuals become economically self. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction. The answers are not supposed to give preference to applicants.

For example Macys adds a tax. Auxiliary aids and services are available upon request to individuals with disabilities. The Work Opportunity Tax Credit is a program that provides employers with incentives to hire employees in certain categories who are more likely to experience significant employment.

Partial WOTC credit requires at least. The Federal Work Opportunity Tax Credit WOTC provides tax incentives for hiring individuals who traditionally face barriers to employment. If so you will need to complete the questionnaire when you.

A tax credit survey is simply a questionnaire designed to identify job applicants covered by a tax incentive. What is a tax credit questionnaire. Ad Help simplify the WOTC process identify eligible employees capture more tax credits.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. ETA Form 9175 Long-Term Unemployment Recipient Self-Attestation Form. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website.

Ad Web-based PDF Form Filler.

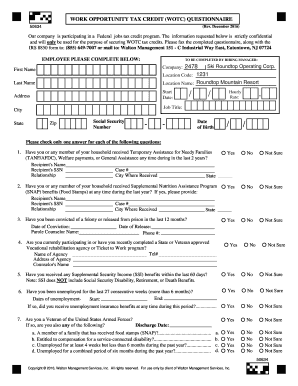

Completing Your Wotc Questionnaire

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

The Top Work Opportunity Tax Credit Questionnaire Target

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Wotc Questions How Much Do You Get With Each Category Cost Management Services Work Opportunity Tax Credits Experts

Application Workflow Work Opportunity Tax Credit Wotc Avionte Aero

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Form Pdf Fill Online Printable Fillable Blank Pdffiller

Adp Work Opportunity Tax Credit Wotc Avionte Bold

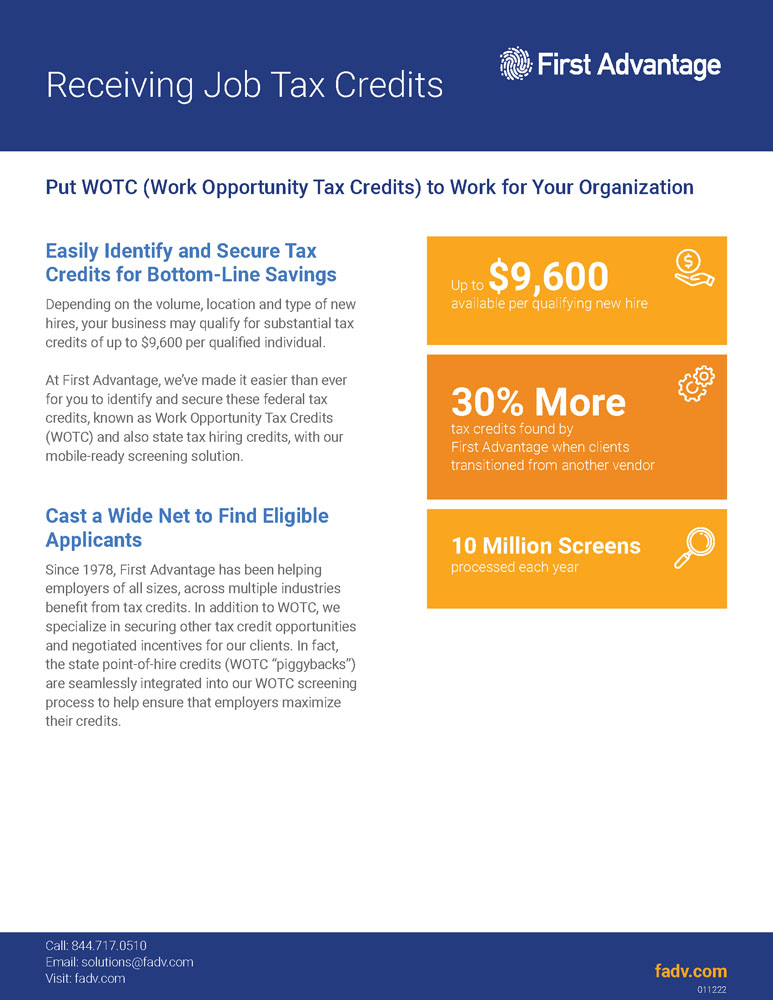

Work Opportunity Tax Credit First Advantage

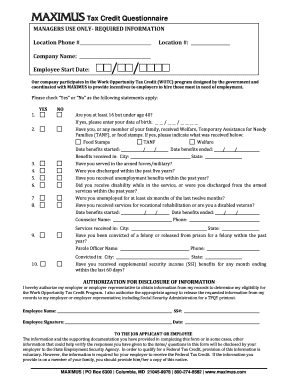

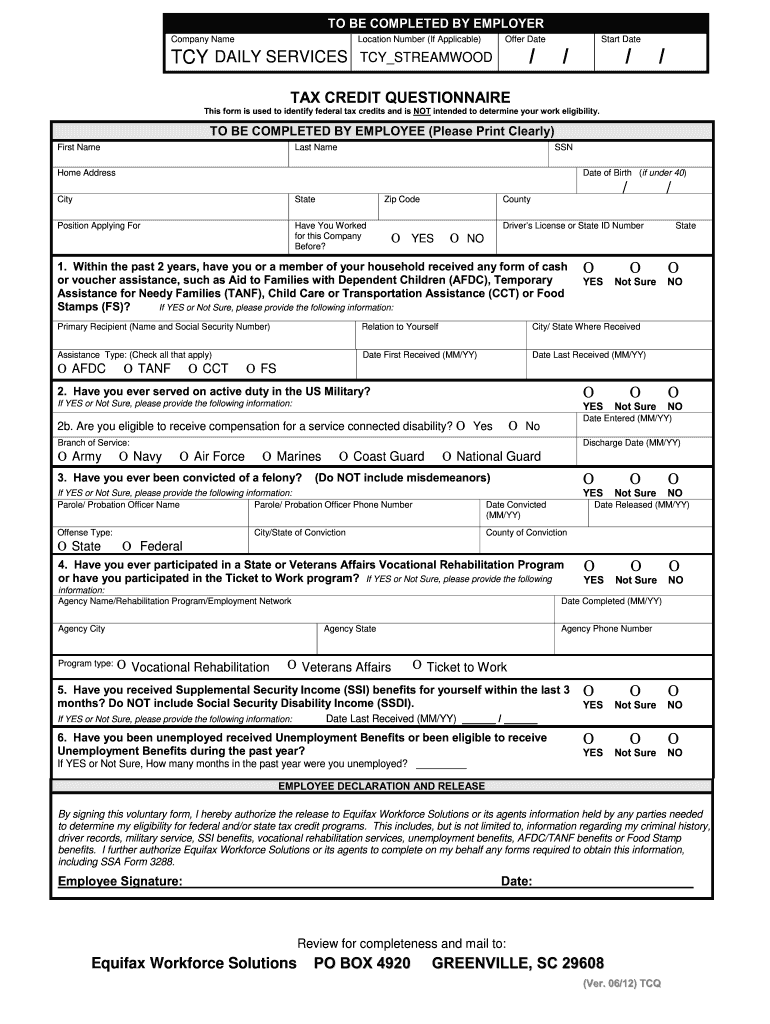

Tax Credit Questionnaire Form Fill Online Printable Fillable Blank Pdffiller

Wotc 101 What Employers Need To Know About The Work Opportunity Tax Credit

Wotc Questionnaire Fill And Sign Printable Template Online Us Legal Forms

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Dol Issues Revised Forms For Work Opportunity Tax Credit Wotc Wotc Planet